Life insurance is an essential financial investment that provides peace of mind and security for your loved ones in the event of your passing even though it’s an unpleasant thought, it’s a reality. However, if you have pre-existing medical conditions, you may wonder if obtaining life insurance is even possible. The good news is that it is indeed possible to secure life insurance coverage, even with pre-existing conditions. Can I Get Life Insurance With Pre-existing Conditions? will inquire the options available to you, ensuring that you are well-informed and equipped to make the best decision for your future. So, let’s dive in and discover how you can obtain life insurance coverage, no matter your health history.

Understanding pre-existing conditions

Pre-existing conditions refer to any medical condition that you already have before applying for a life insurance policy. These conditions can range from chronic illnesses to past surgeries or even mental health disorders. It’s important to understand these conditions and how they may impact your eligibility for life insurance coverage.

Definition of pre-existing conditions

A pre-existing condition is any health condition or illness that you have been diagnosed with or received treatment for before applying for life insurance. This can include common conditions such as diabetes, high blood pressure, cancer, heart disease, or even mental health conditions like depression or anxiety. Insurance companies classify these conditions as pre-existing because they may increase the risk of mortality or require ongoing medical care.

Examples of pre-existing conditions

Some examples of pre-existing conditions include diabetes, asthma, epilepsy, cardiovascular diseases, cancer, mental health disorders, HIV/AIDS, and obesity. These conditions can vary in severity and impact, but it’s essential to disclose all of your medical history when applying for life insurance to ensure accurate coverage.

Impact of pre-existing conditions on life insurance

Pre-existing conditions can have a significant impact on your life insurance coverage. Insurance companies may consider these conditions as higher risk, which can result in higher premiums or even denial of coverage. It’s crucial to understand how your specific pre-existing conditions may affect your ability to obtain life insurance and be prepared for potential challenges.

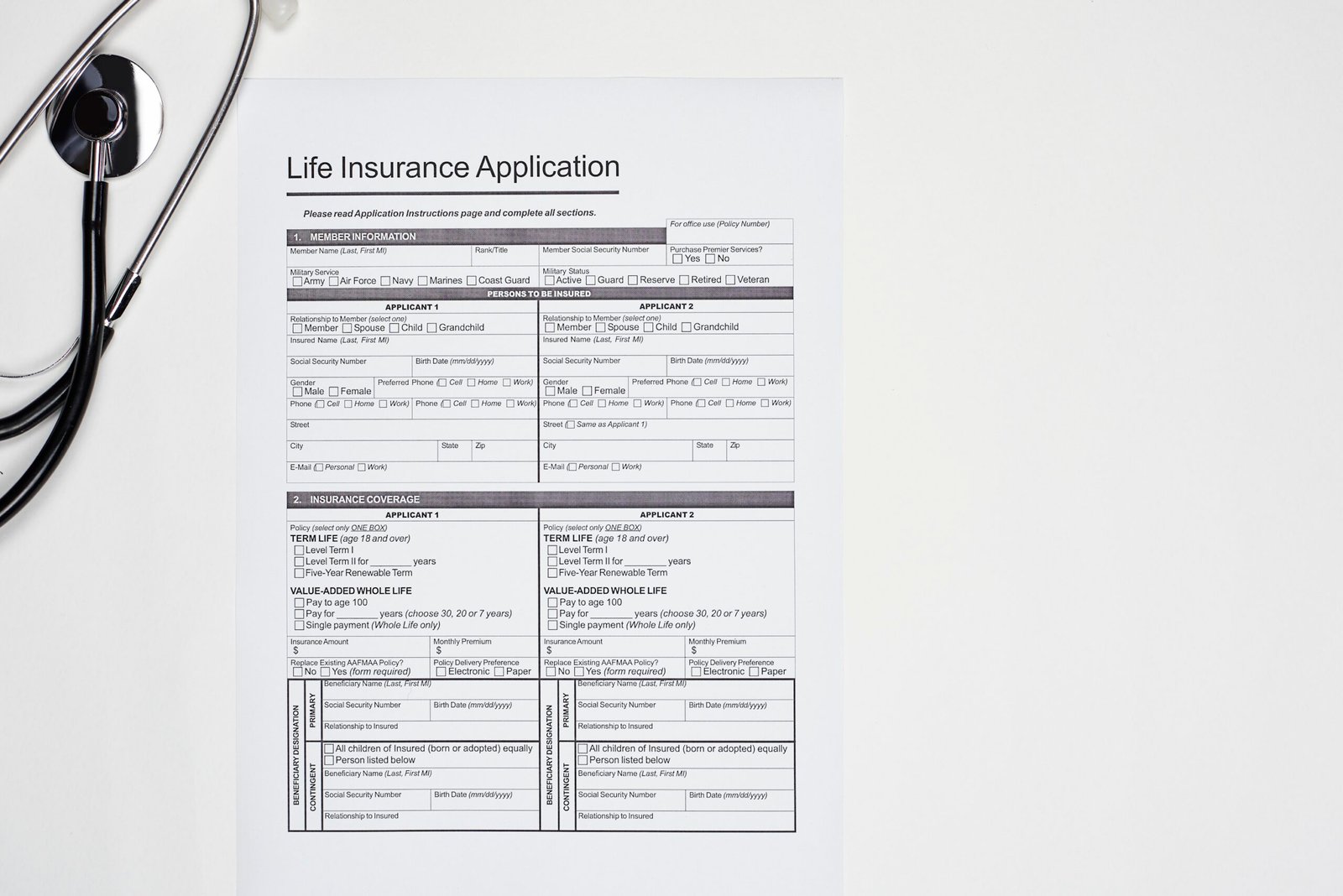

Types of life insurance available

When considering life insurance options, there are three primary types to choose from: term life insurance, whole life insurance, and universal life insurance. Each type offers different benefits and coverage options that may be suitable for individuals with pre-existing conditions.

Term life insurance

Term life insurance provides coverage for a specific period, typically between 10 to 30 years. This type of insurance is generally more affordable and offers a fixed death benefit. However, it does not accumulate cash value like other types of life insurance and may expire before the policyholder’s death.

Whole life insurance

Unlike term life insurance, whole life insurance provides coverage for the entire lifetime of the insured person. It has a cash value component that accumulates over time, allowing policyholders to build up savings. Whole life insurance can be more expensive than term life insurance but offers lifelong coverage and potential financial benefits.

Universal life insurance

Universal life insurance combines the protection of life insurance with the benefits of a cash value component. It provides flexible premiums and death benefits, allowing policyholders to adjust their coverage as needed. This type of insurance can be suitable for individuals who want the ability to change their coverage over time.

How pre-existing conditions affect life insurance

It’s important to recognize that pre-existing conditions can impact your life insurance coverage in several ways. Understanding these effects will help you navigate the application process and make informed decisions about your coverage.

Higher premiums

One of the primary effects of pre-existing conditions on life insurance is the potential for higher premiums. Insurance companies consider the increased risk associated with these conditions and may charge higher monthly or annual premiums to compensate for it. However, the extent of the premium increase will depend on the severity and stability of your pre-existing condition.

Medical underwriting

Insurance companies typically conduct medical underwriting when evaluating applications for life insurance with pre-existing conditions. This process involves a thorough review of your medical history, including past diagnoses, treatments, and current medications. Medical underwriting helps insurers assess the level of risk associated with your pre-existing condition and determine the appropriate premium rates.

Exclusions or limitations on coverage

In some cases, insurance companies may exclude or limit coverage for specific pre-existing conditions. This means that the insurance policy will not provide benefits related to those conditions or may have certain restrictions. For example, coverage for a pre-existing heart condition may come with exclusions for related cardiac events. Understanding these limitations is crucial when selecting a life insurance policy.

Factors influencing life insurance eligibility

Several factors come into play when determining your eligibility for life insurance with pre-existing conditions. Knowing how these factors affect your coverage can help you navigate the application process more effectively.

Severity of pre-existing condition

The severity of your pre-existing condition plays a significant role in determining your life insurance eligibility. Insurance companies assess the impact of your condition on your overall health and mortality risk. Severe conditions may result in higher premiums or even denial of coverage, while mild or well-controlled conditions may have a lesser impact on eligibility.

Stability of the condition

The stability of your pre-existing condition is another important factor insurers consider. If your condition is well-managed, under control, and does not require frequent medical intervention or hospitalization, it may have a lesser impact on your life insurance eligibility. Demonstrating stability through medical records and consistent treatment can improve your chances of obtaining coverage.

Treatment and medication compliance

Insurance companies also consider your adherence to prescribed treatment plans and medication regimens. Consistent compliance demonstrates your commitment to managing your pre-existing condition. A history of regular check-ups and medication adherence can enhance your eligibility and potentially lead to more favorable premium rates.

Steps to take when applying for life insurance with pre-existing conditions

Applying for life insurance with pre-existing conditions requires careful consideration and preparation. Following these steps will help you navigate the process more smoothly and improve your chances of obtaining coverage.

Researching insurance providers

Start by researching insurance providers who specialize in covering individuals with pre-existing conditions. Not all insurers have the same underwriting guidelines and policies. Look for companies with experience in handling cases similar to yours, and read reviews or seek recommendations to ensure their reliability and credibility.

Gathering necessary medical information

Before applying for life insurance, gather all relevant medical information related to your pre-existing condition. This may include medical records, surgical procedures, test results, and a list of current medications. Having this information readily available will streamline the application process and help insurers assess your eligibility more accurately.

Consulting with an insurance agent

Consulting with an experienced insurance agent can provide valuable guidance throughout the application process. An agent specializing in life insurance for individuals with pre-existing conditions can help you navigate the complexities of underwriting, policy selection, and finding the most suitable coverage options for your specific needs.

Strategies to improve the chances of getting life insurance

While obtaining life insurance with pre-existing conditions may present challenges, there are strategies you can implement to improve your chances of securing coverage.

Improving overall health

Prioritizing your overall health and well-being can positively impact your eligibility for life insurance. Engage in regular exercise, maintain a balanced diet, and make lifestyle choices that promote good health. By actively working to improve your health, you may demonstrate to insurance companies that you are taking steps to manage your pre-existing condition effectively.

Maintaining regular medical check-ups

Consistent monitoring and follow-up with healthcare professionals are essential when applying for life insurance with pre-existing conditions. Regular check-ups and medical appointments provide insurers with a better understanding of your condition’s stability and management. This information can help in demonstrating your commitment to ongoing care and enhancing your eligibility.

Disclosing all medical information

It is crucial to disclose all relevant medical information when applying for life insurance. Being transparent about your pre-existing conditions, treatments, and medications ensures that the insurance company has a comprehensive understanding of your health. Failure to disclose accurate information can result in denial of coverage or future insurance claims being denied.

Alternative options for life insurance

If you face challenges in obtaining traditional life insurance due to pre-existing conditions, several alternative options may still provide you with coverage.

Guaranteed issue life insurance

Guaranteed issue life insurance is a type of policy that does not require a medical exam or medical underwriting. These policies are typically available to individuals regardless of pre-existing conditions. However, they often come with lower coverage amounts and higher premiums.

Modified or graded benefit life insurance

Modified or graded benefit life insurance is another alternative for individuals with pre-existing conditions. These policies may have a waiting period before the full death benefit is paid out, and the premium rates may be higher. However, they offer coverage options for those who may have difficulty obtaining traditional life insurance.

Special considerations for pre-existing conditions

When selecting a life insurance policy with pre-existing conditions, it’s essential to consider specific factors that may affect coverage and overall protection.

Insurance waiting periods

Some insurance policies may have waiting periods before coverage takes effect for pre-existing conditions. It’s important to understand the duration of these waiting periods and any restrictions that may apply during that time. Be sure to review the policy terms and conditions thoroughly to avoid any surprises.

Reviewing policy terms and conditions

Before purchasing a life insurance policy, carefully review the terms and conditions provided by the insurance company. Pay attention to any exclusions, limitations, or specific requirements related to pre-existing conditions. Understanding these details will help you make an informed decision about the suitability of the policy for your specific needs.

Coverage for pre-existing conditions

While some policies may exclude coverage for pre-existing conditions, others may offer partial coverage or additional riders to cover specific conditions. It’s important to understand the extent of coverage for your pre-existing condition and consider policies that align with your needs and priorities.

Importance of seeking professional advice

Navigating the world of life insurance with pre-existing conditions can be complex and overwhelming. Seeking professional advice from an insurance expert can provide invaluable guidance and help you make informed decisions.

Consulting with an insurance professional

Consulting with an insurance professional, particularly one experienced in handling cases involving pre-existing conditions, is essential. An insurance professional can guide you through the application process, identify suitable coverage options, and provide personalized advice based on your specific needs and circumstances.

Discussing affordable options

Insurance professionals can assess your budget and financial goals to help you find affordable options for life insurance coverage. They can provide insights into premium rates, payment plans, and potential cost-saving strategies, ensuring that you find a policy that meets your needs without straining your finances.

Exploring rider options

Riders are additional provisions that can be added to a life insurance policy to enhance coverage and tailor it to your specific circumstances. Insurance professionals can help you explore rider options, such as critical illness riders or disability income riders, that may be particularly beneficial for individuals with pre-existing conditions.

Conclusion

Having pre-existing conditions does not necessarily mean you cannot obtain life insurance coverage. By understanding the impact of pre-existing conditions on life insurance, exploring different policy options, and seeking professional advice, you can take proactive steps to secure the coverage you need. Remember to disclose all relevant medical information, research insurance providers, and consider alternative options if necessary. By being informed and proactive, you can protect your loved ones’ financial future while managing your pre-existing conditions effectively.